Pakistan Prime Minister Muhammad Shehbaz Sharif paid an official visit to China from June 4-8, visiting Beijing, Xi’an and Shenzhen.

The Prime Minister met with President Xi Jinping in Beijing on June 7.

President Xi said that China and Pakistan are good neighbours linked by mountains and rivers, good friends who share faith and righteousness, good partners who help each other, and good brothers who share weal and woe. The China-Pakistan all-weather strategic cooperative partnership had continuously deepened and enjoyed solid public support with a strong internal driving force and broad prospects for development.

He added that China is ready to promote the alignment of high-quality Belt and Road cooperation with Pakistan’s development plans, carry out cooperation in agriculture, mining, and social livelihood in light of local conditions, make the high-quality development of the China-Pakistan Economic Corridor (CPEC) go deeper and be more concrete, and help boost Pakistan’s economic and social development.

China is also willing to strengthen coordination and cooperation with Pakistan in the United Nations, the Shanghai Cooperation Organisation (SCO), and other multilateral mechanisms, jointly promote an equal and orderly world multipolarisation and an economic globalisation that is inclusive and benefits all, focus on the development agenda, address security challenges, improve global governance, and safeguard the common interests of developing countries and international fairness and justice.

Shehbaz said that under the leadership of President Xi, China has made great achievements in poverty alleviation, anti-corruption and development, which have attracted worldwide attention.

He added that the CPEC has strongly promoted Pakistan’s national development and brought tangible benefits to the Pakistani people. Pakistan will learn from China’s experience in governance, continue to work with China on high-quality Belt and Road cooperation, and deepen practical cooperation in various fields.

Shehbaz reiterated that no force can stop China’s development and growth or shake the iron-clad friendship between Pakistan and China. Pakistan will continue to firmly support China’s position on all issues concerning its core interests without hesitation.

The Prime Minister also met with Chinese Premier Li Qiang and Zhao Leji, Chairman of the National People’s Congress (NPC) Standing Committee the same day.

Premier Li said that China has always prioritised Pakistan in its neighbourhood diplomacy and stands ready to work with Pakistan to carry forward their traditional friendship, expand mutually beneficial cooperation, and accelerate the construction of a closer China-Pakistan community with a shared future in the new era to bring greater benefits to the two peoples. China is also willing to deepen cooperation with Pakistan in industry, agriculture, aerospace, information technology, ecology and environmental protection.

China will continue to support Pakistan in improving its people’s livelihoods and in its post-disaster reconstruction, and will carry out exchanges and cooperation with Pakistan in the fields of culture, tourism, local governments and think tanks, so that the China-Pakistan friendship will enjoy greater support among the people.

In a detailed joint statement, covering a comprehensive range of issues, the two countries noted that they had reached extensive consensus on further strengthening the China-Pakistan All-Weather Strategic Cooperative Partnership and promoting practical cooperation in various areas, and on international and regional issues of mutual interest.

“The Chinese side reiterated that the China-Pakistan relationship is a priority in its foreign relations. The Pakistani side underscored that the Pakistan-China relationship is the cornerstone of its foreign policy.”

Pakistan believes that the Chinese path to modernisation provides a new option and practical solution for developing countries to achieve independent development.

Both countries recognised that CPEC has been a pioneering project of the Belt and Road Initiative. Since the launch of CPEC, the two sides have adhered to the principle of “planning together, building together, and benefiting together,” which has changed the development landscape of Pakistan, benefited its people’s well-being, and promoted the integrated development of China and Pakistan.

They pledged to upgrade CPEC by jointly building a growth corridor, a livelihood-enhancing corridor, an innovation corridor, a green corridor and an open corridor, aligning with Pakistan’s 5Es Framework based on Exports, E-Pakistan, Environment, Energy, and Equity & Empowerment, to better benefit the two countries and their peoples, working together to build CPEC into an exemplary project of high-quality building of Belt and Road cooperation.

Recognising the significance of Gwadar Port as an important node in cross-regional connectivity, the two sides were satisfied that the New Gwadar International Airport will soon be finished, and reiterated the need to speed up the development of the auxiliary infrastructure of the Gwadar Port in order to fully realise the potential of the coastal city, especially as a transshipment hub.

They also reiterated that CPEC is an open and inclusive platform for win-win cooperation, and welcomed third parties to actively participate in such CPEC cooperation priority areas as industry, agriculture, ICT, science and technology, and mining.

Both sides underscored the importance of maintaining peace and stability in South Asia, the need for resolution of all outstanding disputes, and their opposition to any unilateral action. The Pakistani side briefed the Chinese side on the latest developments of the situation in Jammu and Kashmir. The Chinese side reiterated that the Jammu and Kashmir dispute is left over from history, and should be properly and peacefully resolved in accordance with the UN Charter, relevant UN Security Council resolutions and bilateral agreements.

They jointly advocated an equal and orderly multipolar world and a universally beneficial and inclusive economic globalisation. Both sides opposed hegemony, domineering and bullying, exclusionist approaches, and opposed power politics, as well as unilateralism in all forms.

China reaffirmed that it always remains a firm member of the developing countries. China is willing to work together with Pakistan and other developing countries, following the principles of mutual respect, equality, mutual trust, win-win cooperation, solidarity and coordination, to jointly embark on the path of fair, open, comprehensive and innovative development, promote development and prosperity of most developing countries, and strive to achieve the goals of the 2030 Agenda for Sustainable Development of the United Nations.

The two sides agreed to strengthen communication and coordination on the Afghanistan issue. They both called for concerted efforts of the international community to positively support Afghanistan in properly addressing challenges in such areas as humanitarianism and economic development, encourage the interim government of Afghanistan to build an inclusive political framework, adopt moderate policies, pursue good-neighbourliness, and firmly combat terrorism. They agreed to play a constructive role in helping Afghanistan to achieve stable development and integrate into the international community.

China and Pakistan reiterated that the fundamental way out of the current crisis in Gaza lies in the two state solution and the establishment of an independent State of Palestine. The resolution adopted by the UN Security Council is legally binding, and should be enforced effectively to achieve an unconditional and lasting ceasefire immediately. They called on the international community to increase political input into the Palestinian question with a greater sense of urgency, stepping up efforts to facilitate the early resumption of peace talks between Palestine and Israel, and to strive for enduring peace.

On June 9, the Xinhua News Agency carried an interview with Mohammad Zubair Khan, a prominent Pakistani economist and former Minister of Commerce.

Describing BRI as a “game changer”, Khan noted that, as one of its flagships, CPEC is connecting the warm waters of the Arabian Sea and the Persian Gulf with the entire Asia that lies to the north, through a corridor linking the Gwadar Port in southwest Pakistan’s Balochistan province with Kashgar in northwest China’s Xinjiang Uygur Autonomous Region, which highlights energy, transport, and industrial cooperation in the first phase, while the new phase expands to the fields of agriculture and livelihood, among others.

“It’s not just about trade with the big economy of China, but the Central Asian economies. They can all be connected through the links into CPEC,” he said. The development of Gwadar port under CPEC would play a major role in reducing the bottlenecks Pakistan had been facing in terms of trade, connectivity and access to international markets.

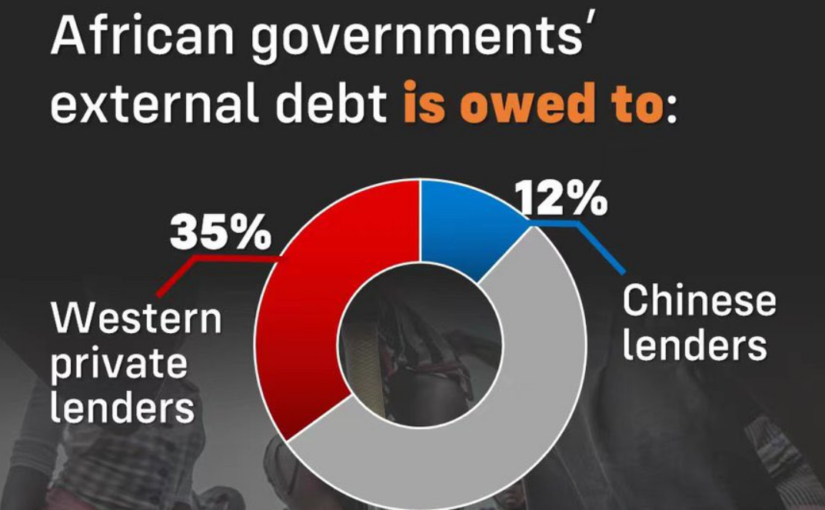

The former minister, who represented Pakistan at the first ministerial conference of the World Trade Organisation, and has vast experience of working with the World Bank and the International Monetary Fund, rejected the West’s allegation that the BRI’s investment model is exploitative in nature and generates debt traps for the countries involved.

Most of Pakistan’s debt is owed to Western creditors, while China’s credit accounts for a very small portion of Pakistan’s total indebtedness, Khan said, adding that the government is indebted in the local currency to the domestic banks as well. The Chinese investment in CPEC, he added, has been initially in the infrastructure which the South Asian country was lacking. It was not driven by China’s own interests, but suited the development needs of Pakistan, he noted.

The following articles were originally published by the Xinhua News Agency.

Continue reading Pakistani PM: no force can stop China’s development or shake the iron-clad friendship between Pakistan and China