We are very pleased to reprint the following article by Efe Can Gürcan, which was originally published in BRIQ Belt and Road Quarterly, Volume 5, Issue 1.

In his article, Dr. Gürcan, who is currently a Visiting Scholar at the London School of Economics and Political Science (LSE) and is a member of the FoSC Britain Committee, argues that the global political economy has long been characterised by the commanding presence of the US dollar – a linchpin that has steadfastly upheld US hegemony across decades. He further endeavours to illuminate the multifaceted interconnections between a multipolar world and the potential reconfiguration of the dollar’s global standing. His findings suggest that China emerges as the principal contender to US hegemony, spearheading initiatives aimed at dedollarisation, with the prevailing trajectory being towards asset diversification in a post-hegemonic context. Evident manifestations of such inclinations are China’s policies on RMB internationalisation, exemplified by the introduction of the CIPS (Cross-Border Interbank Payment System), UnionPay, and the Digital Yuan. These strategies complement the growing prevalence of bilateral trade in alternative currencies, a growing intention to conduct oil trading in non-dollar currencies, currency swap agreements, and the prospective advent of a BRICS currency. Institutionally, this shift is anchored in frameworks such as the New Development Bank, the Shanghai Cooperation Organisation (SCO), the Asian Infrastructure Investment Bank (AIIB), and the Belt and Road Initiative (BRI). The mounting view of dollar dominance as a manipulative instrument of US foreign policy, coupled with the perceived waning of US hegemony and diminishing confidence in the US dollar, impels developing nations to hasten their currency diversification pursuits. This momentum is observed particularly within the framework of South-South cooperation, with China’s proactive stance being a pivotal influence.

Developing his argument, Efe explains that this emergence of multiple power centres, each with its own economic and political clout, threatens to reshape the traditional dynamics of international economic relations, challenging the very sanctity of the dollar’s global supremacy.

He also considers it relevant to address the negative implications of dollarisation for the developing world. Adjustments in US monetary policy have frequently precipitated debt, exchange rate, and financial crises in various developing economies. Noteworthy instances include the Latin American debt crisis of the 1980s, the Asian financial crisis of the 1990s, and the 2018 exchange rate crises in Türkiye, Brazil, Argentina, and other economies, sparked by an increase in US dollar interest rates. Therefore, dollarisation is typically linked with high and unstable inflation, exchange rate fluctuations, and undisciplined monetary policy.

Global confidence in the US dollar has been foundational to its dominance. Such confidence has roots in the United States’ past contributions to global production, its unrivalled military prowess, and its capacity to maintain its currency’s purchasing power through technological advancements and a robust service sector. However, recent geopolitical shifts and the multipolarisation of world politics appear to be eroding this global confidence. China’s ascent as the leading producer and exporter of high-tech goods, combined with the repercussions of the 2007-2008 financial crisis and US military challenges in countries like Afghanistan, Iraq, and Syria, have raised questions about the dollar’s unassailable position.

He cites the work of Daniel McDowell to emphasise that sanctions are a crucial tool in the strategic use of the dollar to counter the emerging powers threatening US hegemony. Primary sanctions aim to directly isolate the targeted individual, company, or government from the dollar-based financial system. In turn, secondary sanctions are designed to exclude the target from global financial networks through the involvement of foreign financial institutions.

Turning to the trend towards dedollarisation, he explains that it emerged against the backdrop of the unprecedented rise of the Latin American left in the 2000s as an important catalyst in multipolarisation, which includes Lula’s Brazil, a leading BRICS+ member. Multipolarisation of the global political economy, he adds, goes hand in hand with the rise of South-South cooperation, embodied not only in the rise of the Latin American left and its social justice-oriented regionalism, but also in the proliferation of Eurasia’s security-oriented regionalism, including the SCO, the Eurasian Economic Union, the Collective Security Treaty Organisation, and other cooperation schemes such as the BRICS+, BRI, and the AIIB. These organisations hold the potential to serve as conduits for dedollarisation in forthcoming years.

Particularly significant are trends in the global energy market. If Saudi Arabia and potentially other Gulf countries start trading oil in yuan or other currencies, this would significantly erode the dollar’s dominant position in global energy markets. Additionally, the March 2023 agreement between Chinese and French energy companies to settle an LNG deal in yuan is also of historic importance. Given the magnitude and importance of energy deals, conducting transactions in currencies other than the dollar could set a precedent for future trade agreements. Equally important is China’s recent move to use the Shanghai Petroleum and Natural Gas Exchange as a platform for yuan settlements with Arab Gulf nations, a strategic effort to bypass the US dollar in energy trade. Given the vast volumes of oil and gas traded between the Gulf and China, this shift could have a significant impact on the demand for the US dollar in global energy markets. A similar situation goes for nuclear energy. The 2023 agreement between Bangladesh and Russia to use the Renminbi for the settlement of a nuclear plant transaction is yet another sign of countries seeking alternatives to the US dollar for significant infrastructure and development projects.

In this evolving landscape, therefore, China is seizing the opportunity to amplify its global financial footprint. In fact, China’s push to reform the dollar-centric global financial system began following the 1997 Asian financial crisis. Dai Xianglong, who was then the Governor of the People’s Bank of China (PBoC), expressed in 1999 that the instability caused by the dominant role of a few national currencies as international reserve currencies, as well as the system’s failure to address balance of payments imbalances, leads to international financial crises. In the wake of the 2007–2008 global financial crisis, Zhou Xiaochuan, Dai’s successor, emphasised the need to overhaul the international monetary system. He proposed an international reserve currency that would be independent of individual nations and identified the weakening dollar as a key factor in the global economic crisis.

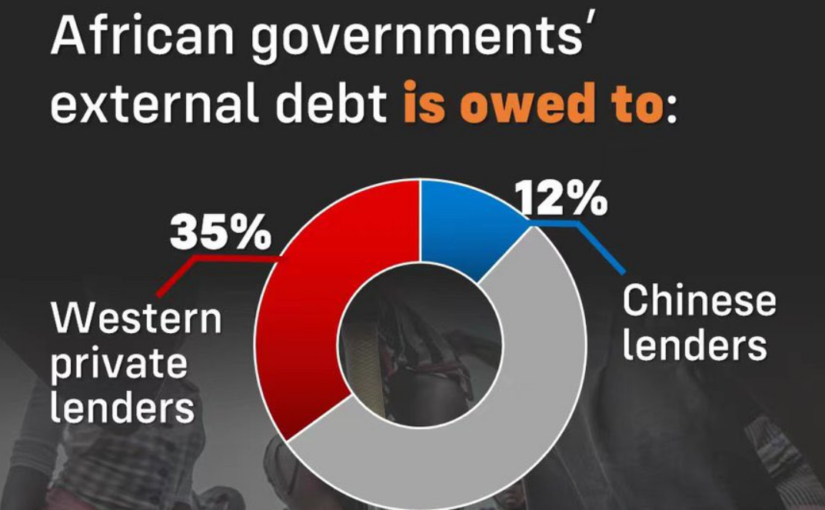

China’s endeavours to reduce reliance on the US dollar and bolster the international stature of its currency, the RMB, have involved strategic maneuvers in global financial diplomacy. An integral part of this strategy has been the establishment of currency swap agreements with developing nations. By 2017, China had entered into swap agreements that amounted to more than $500 billion with 35 countries. Both the number of countries and amount of funds involved have continued to increase significantly.

China’s proactive steps towards dedollarisation and establishing the RMB as an international currency have manifested in various other innovative financial undertakings. Initiated in 2002, China’s UnionPay credit card system was instituted as a competitor to globally renowned credit card giants, Visa and MasterCard. By 2019, UnionPay’s ascendancy in the global credit card market was evident, as it held the lion’s share, accounting for 45% of credit cards in circulation. This significant development is not merely about market competition. It represents a strategic move to offer an alternative financial lifeline to nations, such as Russia, Iran, and Cuba, which, due to Western sanctions, find themselves estranged from the dominant international payment systems.

The advantages of the Digital Yuan are manifold. Beyond expediting financial transactions, the use of this blockchain-driven technology enhances China’s capability for comprehensive financial oversight and synchronisation – key attributes for maintaining a robust economy.

And the BRI stands out as one of China’s most ambitious global projects. While the initiative primarily focuses on infrastructural development and connectivity across continents, it also carries significant financial implications. By financing projects within the BRI framework, China can encourage or even mandate the use of yuan for transactional purposes, thereby promoting its global usage. If the BRI projects are primarily transacted in yuan, it could lead to an increased demand for the currency, thereby internationalising it and challenging the dominance of the US dollar.

Presently, dedollarisation represents a nascent trend, predominantly evident in developing nations seeking to diversify their monetary assets. In this context, the notion of “post-hegemony” encompasses not only the relative waning of US global influence and the rise of alternative power hubs, but also the burgeoning South-South collaboration.

Towards the conclusion of his article, Efe turns his attention specifically to Türkiye, which, he outlines, has articulated on multiple occasions its interest in deepening ties with non-Western multilateral organisations. Ankara has repeatedly signaled its intention to explore membership possibilities within the SCO and BRICS, two prominent platforms that present alternatives to the Western-centric global order. Furthermore, Türkiye’s engagement with the BRI is noteworthy. Within the BRI framework, Türkiye has championed its role in the Middle Corridor Initiative, serving as a critical bridge linking China to Europe, thereby reinforcing its geopolitical and geo-economic significance in Eurasia. Another testament to Türkiye’s eastward gravitation is its active engagement with the AIIB. As an institution primarily led by China, the AIIB has seen Türkiye emerge as one of its main beneficiaries, funneling considerable funds to support Ankara’s expansive infrastructure projects. Türkiye possesses a 2.54% voting share within the AIIB. Following India and Indonesia, Türkiye has emerged as the third-largest beneficiary of AIIB loans. As of 2019, Türkiye received 11% of the total loans extended by the AIIB. The majority of these funds are allocated to the energy sector. However, despite these efforts, and public statements opposing dollar dominance, Türkiye has achieved limited success in moving away from the dollar.

China’s efforts to promote the RMB on the international stage and challenge the hegemony of the US dollar, he concludes, are multifaceted. It is not just about the currency itself but is deeply tied to China’s broader strategic initiatives and global institutional leadership. In this context, the evolving financial landscape is a clear signal that the dominance of the US dollar is being actively challenged in the context of South-South cooperation, as a “post-hegemonic” form of international cooperation. Certainly, the perceived weaponisation of the dollar and the rise of the developing world as a site of resistance to US hegemony, is hastening this shift, as developing countries collaborate to develop and implement alternatives that insulate them from the economic risks of US policy decisions.

Efe Gürcan’s article is a serious study of a key issue in contemporary international political economy and one that deserves careful study.