In this thoughtful and highly informative article, Marc Vandepitte – an author on international politics from Belgium – uncovers some of the secrets behind China’s remarkable economic success, and explains why this success should be considered favourably in Europe.

Marc starts by debunking the narrative gaining ground among Western ‘China-watchers’ that China’s economic outlook is grim; after all, “the country is still achieving growth rates that we can only dream of”, in spite of a US-led containment campaign and assorted other challenges.

Marc notes that China’s per capita GDP has increased by a factor of 50 in the last four decades, and that since 1990 China’s share of global industrial production has increased from 2.5 percent to 35 percent. What’s more, “in terms of industrial production of the future – green production – China is the absolute leader.”

The article goes on to explain how China’s economic success is based on a combination of factors, including its socialist model of land ownership, its huge investment in education and health care, its focus on science and technology, and its striking blend of state-led planning and decentralisation.

China’s dramatic successes are driving development throughout the Global South – in particular via the Belt and Road Initiative – but the country’s emergence is also a boon for the West. “Western economies are closely intertwined with the Chinese economy and in many areas the West needs China more than the other way around. For example, Europe cannot possibly achieve its climate goals without China.”

Marc concludes:

Europe stands at an important crossroads in history. Will it allow itself to be dragged into a destructive trade war initiated by the US, or will it succeed in charting its own autonomous course and building a constructive economic relationship with China, based on mutual benefit? The stakes are high.

Peculiar media framing

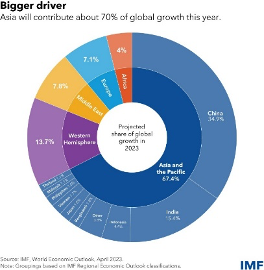

If you believe the mainstream media, China is in bad shape: the economic engine is said to be sputtering, or worse, the economy is in a downward spiral. Bizarre, as the IMF expects economic growth of 4.6 percent in China this year. That is almost five times as much as in Europe and more than three times as much as in the US.

The Western media are apparently struggling with China’s growth miracle, and so they focus blindly on the problems and challenges. By concentrating on what is going less well, they lose sight of what China is very strong at.

Certainly, the Chinese economy is facing some significant challenges, but despite an aging population and increasing hostility from the West, both in terms of investment and trade, the country is still achieving growth rates that we can only dream of.

In this article, we are exploring the reasons for this decades-long spectacular growth. We also look at why this is a good thing and what is the best way for Europe to respond.

Development marathon

Let’s start with the facts. 75 years ago, when the People’s Republic was founded, China was one of the poorest countries in the world. It was an agricultural, underdeveloped country, insignificant in the world economy. Its GDP per capita was half that of Africa’s and one-sixth of Latin America’s GDP.

Since then, the country has embarked on a series of growth sprints growing into a development long distance run. The economic growth over the past forty years was the largest and longest-lasting in world history. During that period, GDP per capita rose by a staggering factor of 50, which is an increase of 10 percent per year. Recently, the average wealth of a Chinese citizen has surpassed that of a European (when also including the southern and eastern regions of mainland Europe).

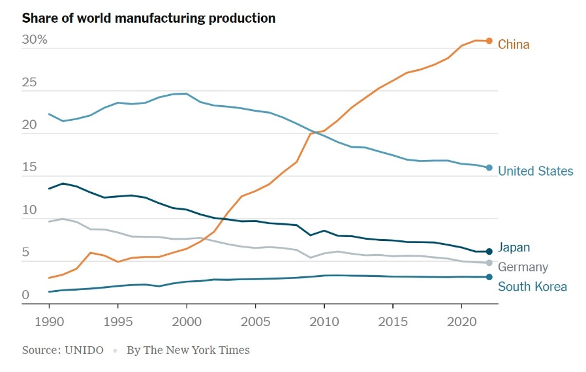

In 1949, the Chinese economy accounted for 4.5 percent of world product. Currently that is 19 percent (expressed in PPP dollars), or 4 percentage points more than the US. If you look at industrial production, things get even more impressive. In 1990, China’s share of global industrial production was 2.5 percent. Today that is 35 percent, as much as the next ten industrial economies combined.

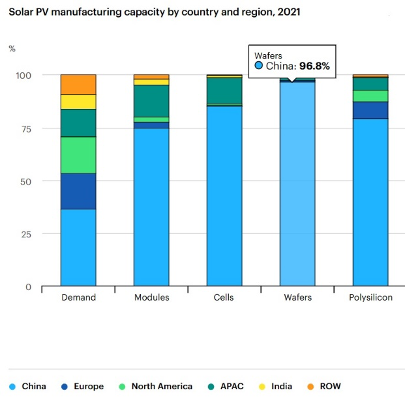

In terms of industrial production of the future – green production – China is the absolute leader. In 2021, it added more offshore wind energy capacity than the rest of the world in the previous five years combined. It leaves all countries far behind in the production of solar panels (see graph) and by 2030 the country will produce more than twice as many electric batteries as all other countries combined.

The country has also managed to keep its economy afloat in the storms of the last 25 years: the Asian financial crisis in 1997, the dot-com crisis in 2001, the SARS crisis at home, the great financial crisis of 2008 and recently the COVID crisis. In relation to the 2008 crisis, former Financial Times journalist Richard McGregor wrote that “China was better equipped than just about anywhere in the world to handle the sudden downturn”.

The growth is not only quantitative, but also qualitative. Great leaps forward have been made in technology and science. Today, Chinese companies are widely recognized as world leaders, or as being at cutting-edge, in 5G telecommunications equipment, high-speed trains, high-voltage transmission lines, renewable energy sources, new energy vehicles, digital payments, artificial intelligence and many other areas.

Good thing

This economic expansion is also manifesting itself globally. China is the main driving force of the world economy, accounting for 35 percent of total growth last year. Many countries, including Europe and the US, benefit from this locomotive function. In 2023, China was the most important trading partner of about 120 countries and the lender of first and last resort for many.

And of course there is the Belt and Road Initiative, the new Silk Road, which represents hundreds of investments, loans, trade agreements and dozens of Special Economic Zones, worth $900 billion. They are spread over 72 countries, with a total population of approximately 5 billion people or 65 percent of the world’s population.

In addition, there is an increasing cooperation with countries from the South in the context of BRICS plus. Within this alliance, experiments are in full swing to move away from the dominance of the dollar by conducting trade transactions in local currencies.

For the countries of the Global South, economic expansion is a very good thing. It gives them the opportunity to get rid of Western dominance and finally break with colonialism, this time economically. The dominant financial and economic players in the West are watching this with dismay, which is why they are growing more and hostile towards China (see below).

Nevertheless, China’s economic rise is also a good thing for the countries of the North. Cheap Chinese products keep inflation low and we can sell a lot of our goods and investments to the Asian giant’s huge sales market.

Recipe

The key ingredients of the Chinese growth miracle are the following:

1. Agriculture. At the beginning of the revolution, large land ownership was abolished and agricultural land was given on long term loans to the peasants. In addition, a system of personal registration (Hukou) was set up. This has avoided the typical chaotic rural exodus known in most Third World countries, resulting in massive informal and unproductive labour.

2. Social policy. From the start, a relatively large amount has been invested in education, health care and social security. This ensures a healthy and skilled workforce, which improves productivity.

Wages largely follow productivity increases, which on the one hand leads to social peace in the workplace and on the other hand has created a large and dynamic internal market.

3. Infrastructure, technology and R&D. China is fully committed to the development of infrastructure, ‘Research & Development’ and the development of (cutting-edge) technology. These are basic conditions for any economic progress. In 2018, China overtook the US in terms of the number of scientific publications and in 2019, the same was true for the number of patents. Today, four times as many students graduate in STEM fields in China as in the US.

4. Openness. Compared to other emerging countries, there has been great openness to foreign investment and foreign trade since 1978. The large and relatively cheap labour market has attracted many foreign investors who benefit from (temporarily) lower labour costs and an extensive internal market.

Neither foreign investments nor foreign trade are goals in themselves but are functions of national economic goals and domestic development, see for example technology transfer. Today, the new Silk Road also contributes to economic expansion.

5. Stable policy. Compared to many other countries in the Global South, China has maintained relatively stable political and economic policies. This has contributed to the confidence of both domestic and foreign investors.

6. Geopolitics. Apart from a few minor incidents on the border with India, the country has not been involved in violent international conflict for decades. This improves the economic climate in terms of both investments and trade. In addition, unlike the Soviet Union, China has not embarked on an expensive arms race with the US.

7. Planning and control. China’s economic development model is largely led by the state, which is a many-headed entity (see next item). The key sectors of the economy are in the hands of the government, centrally or locally. In addition, the government indirectly controls most of the other sectors, e.g. through the controlling presence of the Communist Party in most (medium) large companies.

A five-year plan creates a favourable framework for a robust industrial policy that helps China move up to higher value-added manufacturing. The model also includes state-owned banks providing favourable loans to strategic industries.

This management and planning allow effective mobilisation of the country’s producers for strategic objectives. Thus, a plan and strict guidelines were issued by the central government to prioritize the solar industry. A few years later, China dominated this sector. This mobilising force is currently being deployed for the development of semiconductors to offset the boycott and US sanctions in this sector.

8. Decentralization and market forces. Contrary to the idea that China is a centrally planned economy, the country actually has one of the most decentralized systems in the world. Local governments have a remarkable degree of autonomy, managing 85 percent of total government expenditure. In the OECD countries this is on average only 33 percent.

This decentralization stimulates competition between provinces and large cities, which is a first sphere of competition. In addition, companies compete in the market, both internally and with the rest of the world, which is the second sphere. Due to this dual system of competition, companies are not only constantly evolving, but there is also great dynamism in the economic landscape.

For example, regularly one province or another implements a new policy that proves to be very effective, giving them an advantage over other regions, after which the initiative is copied by those others.

The role of the central government lies mainly in setting broad objectives and managing human resources. The latter is very functional because local officials know that if they do better than their colleagues, they are on track for promotion by the central government.

In other words, in this model there is room for (quite a lot of) private initiative within a well-defined market system. Please note that the market mechanism is tolerated and encouraged as long as it does not hinder the economic and social objectives (of the joint long-term planning). Or as Rana Foroohar, editor-in-chief of Financial Times, puts it: “The free market is always in service to the state, not the other way around.”

In this respect, the Chinese model clearly differs from that of the Soviet Union. There, everything was planned down to the last detail, almost all production was in the hands of the government and there was little or no competition.

Certainly, what the Soviet Union achieved economically in its first sixty years is unparalleled. But due to the elimination of the market mechanism, there was almost no economic incentive to encourage producers to produce economically, profitably or with high quality. In China this problem has been overcome.

9. Flexibility. The Chinese communists have a pragmatic and down-to-earth attitude towards economic policy. They respond flexibly to changing circumstances. Since the end of the 1970s, the expansion and modernization of the productive forces has been the central objective. At the time the model was based on exports and on investments in heavy industry, construction, manufacturing and infrastructure.

Since Xi Jinping took office about ten years ago, the driving force of the new model has been increasing prosperity (domestic market), increasing the service sector and creating greater added value by climbing higher up the technological ladder.

Completely misjudged

The Chinese recipe is in stark contrast to that of capitalist countries. There, multinationals and finance capital hold sway. There, short-term profit is the overriding goal. And there, governments are fixated on eliminating fiscal deficits through savings.

Characteristic of the Chinese approach is the spectacular way in which they tackled the financial crisis of 2008-2009. The Chinese government launched a stimulus program of 12.5 percent of GDP, probably the largest peacetime program ever. The Chinese economy barely budged while Europe’s was out of steam for a decade.

Eurocentrism and persistent complacency have caused the West to completely misunderstand the Chinese economy and society. When the US and Western countries allowed China to join the World Trade Organization in 2001, it was assumed that China would become like us. By integrating it into the world market, China would abandon socialism and embrace capitalism.

But the opposite seems to be happening. China has stuck to its socialist course and has also succeeded in making our economies more like theirs. Both Europe (Green Deal) and the United States (Inflation Reduction Act) have dropped their laissez-faire approach and a few years ago switched to a real industrial policy, characterized by handing out hundreds of billions in subsidies, something we have always blamed the Chinese for. Things may change …

Quo vadis Europe?

But things don’t stop at imitation. Today, the United States is doing everything it can to sabotage Chinese economic progress. Not only do they deny China access to certain technologies, they also try to undermine entire industries, including by preventing the export of high-tech chips to China.

For example, US National Security Advisor Jake Sullivan said in a speech that his administration wanted to hamper China’s capabilities in “foundational technologies” such as artificial intelligence, biotechnology and clean energy technologies, in order to enable the US to maintain the greatest possible lead on climate change.

Washington is trying to drag Western allies into this economic war. But that won’t happen as a matter of course. Western economies are closely intertwined with the Chinese economy and in many areas the West needs China more than the other way around. For example, Europe cannot possibly achieve its climate goals without China.

The costs of a trade war may be very high. Without cheap exports and production from China, there will be significant inflationary pressures in industrialized countries, especially regarding the transition to cleaner technologies.

According to the IMF, the costs of economic ‘decoupling’ from China and the choice of protectionism could amount to an alarming 7 percent of world GDP, which would amount to more than $7 trillion today. That is 35 times the total official development assistance and 3.5 times as much as what is needed annually to achieve the energy transition.

A trade war with China will inevitably lead to retaliatory measures. Apart from potentially large financial losses due to loss of exports to China, the country also possesses essential goods on which we are heavily dependent.

For example, 90 percent of the specialized magnets needed in electric vehicle engines, wind turbine generators and missile guidance systems are produced in China. In addition, China processes 72 percent of the world’s cobalt and 61 percent of lithium, two essential minerals for the production of electric cars.

Finally, there is a high probability that US sanctions will have exactly the opposite effect of what Washington had in mind and will actually encourage China to accelerate the development of its strategic industries. This is now happening in the field of semiconductors and chips.

The whole question is whether Europe will be drawn into this new Cold War logic and thus shoot itself in the foot. Economically, Europe is more exposed to China than the US is. For instance, China is Germany’s largest trading partner and a crucial market for German industrial companies. The centre of gravity of the global economy is increasingly shifting towards Asia, with China as the locomotive. For Europe, it would be very unwise to miss out on this growth momentum.

Europe stands at an important crossroads in history. Will it allow itself to be dragged into a destructive trade war initiated by the US, or will it succeed in charting its own autonomous course and building a constructive economic relationship with China, based on mutual benefit? The stakes are high.

Sources

- Yifu Lin J., Demystifying the Chinese Economy, Cambridge 2012

- Hsueh R., China’s Regulatory State. A New Strategy for Globalization, London 2011

- Herrera R. & Zhiming Long., La Chine est-elle capitaliste ?, Paris 2019

- Marsh C., Unparalleled Reforms. China’s Rise, Russia’s Fall, and the Interdependence of Transition, Lanham 2005

- Dickson B., Ted Capitalists in China. The Party, Private Enterpreneurs and Prospects for Political Chance, Cambridge 2003

- Minqi Li, The Rise of China and the Demise of the Capitalist World Economy, New York 2008

- Minqi Li, China and the 21st Century Crisis, London 2016

- Delaunay J., Les Trajectoires chinoises de modernization et de développement. De l’Empire agro-militaire à l’État-Nation et au socialism, Paris 2018

- Bickers R., Out of China. How the Chinese Ended the Era of Western Domination, London 2017

- Ross J., China’s Great Road. Lessons for Marxist theory and socialist practices. Articles 2010-21, New York 2021

- Larcy N., The State Strikes Back. The End of Economic Reform in China? Washington 2019

- Mahbubani K., Has China Won? The Chinese Challenge to American Primacy, New York 2020