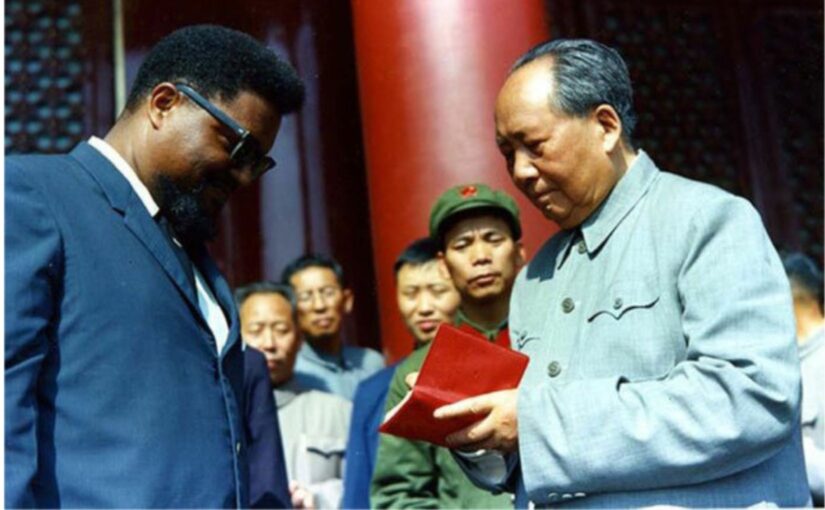

A historic leader of the multinational US proletariat, and student of Mao Zedong, José Jiménez, popularly known as Cha Cha, passed away in Chicago on January 10, 2025. He was 75 according to the Freedom Road Socialist Organisation (FRSO) and 76 according to the New York Times.

Jiménez was the Chairman of the Young Lords Organisation, a youth organisation of the Puerto Rican national minority in the United States, who took up revolutionary organising and the study of Marxism-Leninism and who supported and forged links with socialist China.

Extending condolences to his family, friends and comrades, FRSO wrote:

All those who knew him appreciated Jiménez’s determination and his ability to motivate others to action, all the while teaching about the need for revolution and socialism. A revolutionary to the end, he often quoted Mao Zedong on the united front strategy, ‘Unite the many to defeat the few!’

The Young Lords Organisation was founded… in 1968 in the Lincoln Park neighbourhood of Chicago. Puerto Ricans and other working people were being forced out of the now wealthy neighbourhood by big financiers and real estate firms working with Mayor Richard Daley’s Democrat political machine.

At that time, Jiménez turned a street gang into one of the most successful political movements of its day, resisting community displacement and opposing the US war in Vietnam. Their militant tactics attracted masses of people to protest for better housing, education, childcare and health care in Chicago. The Young Lords spread to New York and many other cities, inspiring Puerto Rican people who were forced to move from the island by US domination and exploitation.

FRSO’s article, published on January 17, also details how the Young Lords under Jiménez’s leadership, forged links with and learned from the Black Panther Party, especially Fred Hampton, as well as a number of other organisations, particularly the Brown Berets, who were fighting for Chicano self-determination, and the Young Patriots, a youth group of poor whites from Appalachia. Together they formed the original Rainbow Coalition.

A July 2019 interview with Jiménez’s conducted by FRSO’s Fight Back News! is full of fascinating and important details of those times, which remain rich in lessons for revolutionary and progressive struggles in the United States and elsewhere. Towards the end he manages to conflate two of Mao Zedong’s most famous and important sayings into a single short sentence:

“We must be clear on who are our enemies and who are our friends so that we can unite with the many to defeat the few.”

And added: “Ours is not about individuals but a people’s struggle led by the common folk. Ours is a protracted struggle that will take years and we must prepare ourselves for the long run via structured community programs specific to the revolution. We stand for Puerto Rico, all Latin American nations and oppressed nations of the world, against colonialisms and for self-determination and neighbourhood empowerment.”

The New York Times published a detailed obituary of Jiménez on January 22, which even quoted from the FRSO interview.

We reprint below the obituary from FRSO as well as their 2019 interview.

Among various books on the subject, The Young Lords – A Radical History by Johanna Fernández, published by the University of North Carolina Press, is a sympathetic but critical history.

The Young Lords Speak: From the Streets of Chicago to Revolutionary Organization – Edited by Jacqueline Lazú and with a foreword by José Jiménez, written just before his passing, is due to be published by Haymarket in August.

The Young Lords: A Reader is another title that allows its members to speak in their own voice as does Palante: Young Lords Party.

FRSO: Remembering Cha Cha Jiménez

The Freedom Road Socialist Organization shares its condolences with the family, friends and comrades of Jose “Cha Cha” Jimenez, chairman of the Young Lords Organization. He died on January 10, 2025, at the age of 75 in Chicago.

All those who knew him appreciated Jimenez’s determination and his ability to motivate others to action, all the while teaching about the need for revolution and socialism. A revolutionary to the end, he often quoted Mao Tse Tung on the united front strategy, “Unite the many to defeat the few!”

Continue reading Remembering Cha Cha Jiménez