Chinese President Xi Jinping visited Astana, the capital of Kazakhstan, from June 16-18, at the invitation of his Kazakh counterpart Kassym-Jomart Tokayev, to attend the Second China-Central Asia Summit. They were also joined by the Presidents of Uzbekistan, Kyrgyzstan, Tajikistan and Turkmenistan. The first China-Central Asian Summit was hosted by President Xi in Xi’an in May 2023.

Xi Jinping made a keynote speech at the summit on June 17.

Recalling the Xi’an gathering, he said:

- Two years on, China and Central Asian countries have further deepened and substantiated Belt and Road cooperation. Our trade has grown by 35 percent, and we have made important progress in industrial investment, green mining, technological innovation, and other fields of cooperation.

- Two years on, the China-Kyrgyzstan-Uzbekistan railway project has been officially launched. We are making steady progress in planning for the third railway link between China and Kazakhstan, in phase-II restoration of the China-Tajikistan highway, and in China-Turkmenistan energy cooperation.

The Chinese President went on to note that: “Our cooperation is rooted in more than 2,000 years of friendly exchanges, cemented by solidarity and mutual trust cultivated through more than three decades of diplomatic ties, and taken forward via openness and win-win cooperation of the new era.”

Building on our collective efforts over the years, we have forged a China-Central Asia Spirit of “mutual respect, mutual trust, mutual benefit, and mutual assistance for the joint pursuit of modernization through high-quality development”:

- We practice mutual respect and treat each other as equals. All countries, big or small, are equal. We handle issues through consultation and make decisions by consensus.

- We seek to deepen mutual trust and enhance mutual support. We firmly support each other in safeguarding independence, sovereignty, territorial integrity, and national dignity.

- We pursue mutual benefit and win-win cooperation and strive for common development. We view each other as priority partners and share development opportunities together.

- We help each other in time of need and stand together through thick and thin. We support each other in choosing development paths suitable to our respective national conditions and in taking domestic matters into our own hands.

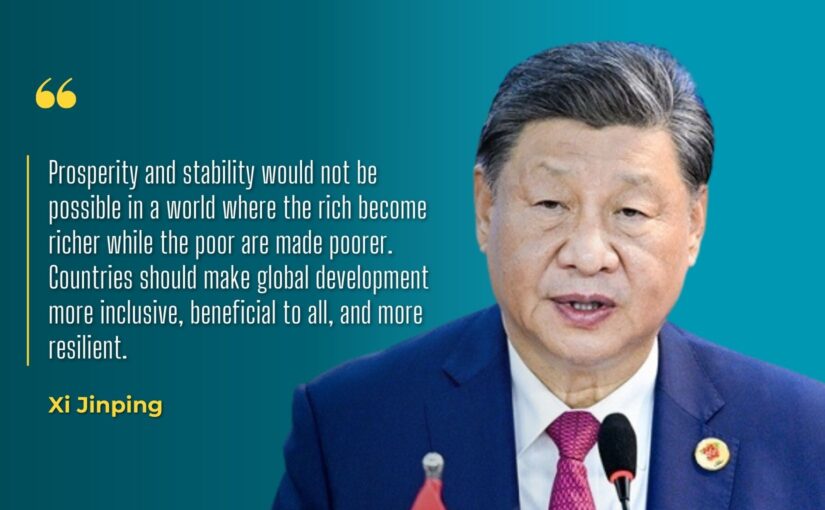

“Today, unprecedented changes are unfolding at a faster pace across the globe, thrusting the world into a new state of heightened turbulence and volatility. A strong belief in fairness and justice and an unyielding commitment to mutual benefit and win-win cooperation are the only way to maintain world peace and achieve common development. There is no winner in tariff wars or trade wars. Unilateralism, protectionism and hegemonism will surely backfire while hurting others.” Going forward:

- We should stay committed to our fundamental goal of unity and always trust and support each other. Today, we will sign together a treaty on eternal good-neighborliness, friendship and cooperation to enshrine the principle of everlasting friendship in the form of law. This is a new landmark in the history of the relations between our six countries and a pioneering initiative in China’s diplomatic engagement with its neighbors. It is a milestone for today and a foundation for tomorrow.

- We should optimize our cooperation framework to make it more results-oriented, more efficient, and more deeply integrated. We have agreed to designate 2025 and 2026 as the Years of High-Quality Development of China-Central Asia Cooperation. We should focus our cooperation on smooth trade, industrial investment, connectivity, green mining, agricultural modernization and personnel exchanges, and roll out more projects on the ground. In order to promote relevant cooperation, China has decided to establish three cooperation centers, i.e. on poverty reduction, on education exchange, and on desertification prevention and control, as well as a cooperation platform on smooth trade under the China-Central Asia cooperation framework.

- We should develop a security framework for peace, tranquility and solidarity. We should step up regional security governance, deepen law enforcement and security cooperation, jointly prevent and thwart extreme ideologies, and resolutely fight terrorism, separatism and extremism, so as to maintain peace and stability in our region. Afghanistan is our close neighbor. We should strengthen coordination to help the country boost its development capacity and achieve peace, stability, reconstruction and development at an early date.

- We should cement the bonds of shared vision, mutual understanding and mutual affection between our peoples. We will make good use of sister-city relations and people-to-people exchanges to nurture heart-to-heart connections at central and subnational levels, [and] between official and non-governmental actors.

- We should uphold a fair and equitable international order and an equal and orderly world structure. China supports Central Asian countries in playing a bigger role in international affairs. We stand ready to work with all parties to defend international fairness and justice, oppose hegemonism and power politics, and promote an equal and orderly multipolar world and a universally beneficial and inclusive economic globalization. This year marks the 80th anniversary of the victory of the Chinese People’s War of Resistance Against Japanese Aggression and the World Anti-Fascist War, and the 80th anniversary of the founding of the United Nations. In the strenuous times of war, Chinese and Central Asian peoples supported each other through adversity, and jointly made important contributions to the cause of justice of humanity. We should promote the correct view of history, defend the fruits of the victory of World War II, uphold the UN-centered international system, and provide more stability and certainty for world peace and development.

Concluding, Xi said: “China is building a great modern socialist country in all respects and advancing the great rejuvenation of the Chinese nation on all fronts through Chinese modernization. No matter how the international situation changes, China will remain unwavering in opening up to the outside world and embrace higher-quality cooperation with Central Asian countries to deepen the integration of interests and achieve common development.”

We reprint below the full text of President Xi’s speech. It was originally published by the Xinhua News Agency.

Championing the China-Central Asia Spirit For High-Quality Cooperation in the Region

Keynote Speech by H.E. Xi Jinping, President of the People’s Republic of China, at the Second China-Central Asia Summit, Astana, June 17, 2025.

Your Excellency President Kassym-Jomart Tokayev,

Distinguished Colleagues,

Friends,

I am delighted to join you at the second China-Central Asia Summit in the beautiful city of Astana. I’d like to thank President Tokayev and the government of Kazakhstan for the gracious hospitality and thoughtful arrangement.

During our meeting in Xi’an two years ago, we jointly outlined the Xi’an Vision for China-Central Asia cooperation. The six pomegranate trees we planted together are in full bloom today, auguring the vitality of the cooperation among the six nations.

Two years on, China and Central Asian countries have further deepened and substantiated Belt and Road cooperation. Our trade has grown by 35 percent, and we have made important progress in industrial investment, green mining, technological innovation, and other fields of cooperation. The package of projects with Chinese financial support are well underway. While more and more Chinese new energy vehicles and photovoltaic products are entering Central Asian markets, Central Asian agricultural products, including honey, fruits, wheat and poultry, are diversifying the dinner tables of Chinese families.

Two years on, the China-Kyrgyzstan-Uzbekistan railway project has been officially launched. We are making steady progress in planning for the third railway link between China and Kazakhstan, in phase-II restoration of the China-Tajikistan highway, and in China-Turkmenistan energy cooperation. Freight train services are connecting more and more Chinese cities to Central Asia. The Trans-Caspian International Transport Route has been upgraded and expanded. Green industries, digital economy, artificial intelligence, aviation and space are becoming new drivers of our cooperation. Cross-border e-commerce, online education, and other new business models are benefiting more and more people in China and Central Asia.

Two years on, China and Central Asian countries have made progress in establishing cultural centers in each other as well as in opening branches of Chinese universities and Luban Workshops. China has made mutual visa-free arrangements with Kazakhstan and Uzbekistan, facilitating more than 1.2 million travels between China and Kazakhstan alone in 2024. Tourism and culture years and art festivals of Central Asian countries are very popular in China. Chinese films and TV dramas, such as Min-Ning Town and To the Wonder, have become great hits in Central Asia. The China-Central Asia train services for cultural tourism have been successfully inaugurated. And today, we will witness the number of sister cities between China and Central Asia reach the milestone of 100 pairs.

Two years on, we have launched 13 ministerial cooperation platforms under the China-Central Asia mechanism. The Secretariat is fully functioning, and the core framework of the mechanism is largely in place.

I am pleased to see that our consensus at the first Summit has been implemented across the board — from the millennium-old Xi’an to Astana “the pearl of the steppe,” from the coast of the Yellow Sea to the shores of the Caspian Sea, from the Tianshan Mountain Range to the Pamir Plateau. The path of our cooperation is steadily widening, and our friendship is blooming ever more brightly.

Distinguished Colleagues,

Friends,

Our cooperation is rooted in more than 2,000 years of friendly exchanges, cemented by solidarity and mutual trust cultivated through more than three decades of diplomatic ties, and taken forward via openness and win-win cooperation of the new era. Building on our collective efforts over the years, we have forged a China-Central Asia Spirit of “mutual respect, mutual trust, mutual benefit, and mutual assistance for the joint pursuit of modernization through high-quality development.”

— We practice mutual respect and treat each other as equals. All countries, big or small, are equal. We handle issues through consultation and make decisions by consensus.

— We seek to deepen mutual trust and enhance mutual support. We firmly support each other in safeguarding independence, sovereignty, territorial integrity, and national dignity. We do not do anything harmful to the core interests of any party.

— We pursue mutual benefit and win-win cooperation and strive for common development. We view each other as priority partners, and share development opportunities together. We accommodate each other’s interests, and work to build a win-win and symbiotic relationship.

— We help each other in time of need and stand together through thick and thin. We support each other in choosing development paths suitable to our respective national conditions and in taking domestic matters into our own hands. We work together to address various risks and challenges, and uphold regional security and stability.

This China-Central Asia Spirit is an important guideline for our endeavor to carry forward friendship and cooperation from generation to generation. We should always uphold it and let it shine forever.

Distinguished Colleagues,

Friends,

Today, unprecedented changes are unfolding at a faster pace across the globe, thrusting the world into a new state of heightened turbulence and volatility. A strong belief in fairness and justice and an unyielding commitment to mutual benefit and win-win cooperation are the only way to maintain world peace and achieve common development. There is no winner in tariff wars or trade wars. Unilateralism, protectionism and hegemonism will surely backfire while hurting others.

I always maintain that history should move forward, not backward; and the world should be united, not divided. Humanity must not regress to the law of the jungle. Instead, we should build a community with a shared future for mankind.

Three years ago, we announced together that we would build a China-Central Asia community with a shared future, setting out the goal and direction of our six nations in building consensus, overcoming challenges and pursuing development. We should act on the China-Central Asia Spirit, enhance cooperation with renewed vigor and more practical measures, promote high-quality development of the Belt and Road Initiative, and forge ahead toward our goal of a community with a shared future for the region.

First, we should stay committed to our fundamental goal of unity, and always trust and support each other. China consistently takes Central Asia as a priority in its neighborhood diplomacy. With a firm belief in an amicable, secure and prosperous neighborhood as well as a strong dedication to amity, sincerity, mutual benefit and inclusiveness, China interacts with Central Asian countries on the basis of equality and sincerity. We always wish our neighbors well.

Today, we will sign together a treaty on eternal good-neighborliness, friendship and cooperation to enshrine the principle of everlasting friendship in the form of law. This is a new landmark in the history of the relations between our six countries and a pioneering initiative in China’s diplomatic engagement with its neighbors. It is a milestone for today and a foundation for tomorrow.

Second, we should optimize our cooperation framework to make it more results-oriented, more efficient, and more deeply integrated. We have agreed to designate 2025 and 2026 as the Years of High-Quality Development of China-Central Asia Cooperation. We should focus our cooperation on smooth trade, industrial investment, connectivity, green mining, agricultural modernization and personnel exchanges, and roll out more projects on the ground. We should do our best to get early harvests as soon as possible.

China is ready to share with Central Asian countries development experience and latest technological advances, promote connectivity in digital infrastructure, enhance cooperation on artificial intelligence, and foster new quality productive forces.

In order to promote relevant cooperation, China has decided to establish three cooperation centers, i.e. on poverty reduction, on education exchange, and on desertification prevention and control, as well as a cooperation platform on smooth trade under the China-Central Asia cooperation framework. China will provide a grant of RMB 1.5 billion yuan to Central Asian countries this year to be used in livelihood and development projects high on their agenda. China will also provide 3,000 training opportunities to Central Asian countries in the next two years.

Third, we should develop a security framework for peace, tranquility and solidarity. We should step up regional security governance, deepen law enforcement and security cooperation, jointly prevent and thwart extreme ideologies, and resolutely fight terrorism, separatism and extremism, so as to maintain peace and stability in our region.

China supports Central Asian countries in modernizing their national defense, law enforcement and security capacities. We will do our best to help Central Asian countries combat terrorism and transnational organized crime and safeguard cybersecurity and biosecurity. We will launch more Safe City projects, and conduct more joint exercises and joint training cooperation.

Afghanistan is our close neighbor. We should strengthen coordination to help the country boost its development capacity and achieve peace, stability, reconstruction and development at an early date.

Fourth, we should cement the bonds of shared vision, mutual understanding and mutual affection between our peoples. China will enhance cooperation between legislatures, political parties, women, youth, media and think tanks with Central Asian countries, conduct in-depth exchange of governance experience, and share experience in green development, poverty reduction and anti-corruption.

China is ready to set up more cultural centers, university branches and Luban Workshops in Central Asia, and launch new majors in Central Asian languages in Chinese universities. We will continue to carry out effectively the “China-Central Asia technology and skills improvement scheme” to train more high-caliber talent for Central Asian countries.

China supports deepening subnational cooperation with Central Asia. We will make good use of sister-city relations and people-to-people exchanges to nurture heart-to-heart connections at central and subnational levels, between official and non-governmental actors, and from adjacent to broader areas.

I hope that the travel-facilitation measures we adopt today will be implemented as soon as possible to help our people visit each other more conveniently, efficiently and frequently like relatives, and in the course help them become ever closer to each other.

Fifth, we should uphold a fair and equitable international order and an equal and orderly world structure. China supports Central Asian countries in playing a bigger role in international affairs. We stand ready to work with all parties to defend international fairness and justice, oppose hegemonism and power politics, and promote an equal and orderly multipolar world and a universally beneficial and inclusive economic globalization.

This year marks the 80th anniversary of the victory of the Chinese People’s War of Resistance Against Japanese Aggression and the World Anti-Fascist War, and the 80th anniversary of the founding of the United Nations. In the strenuous times of war, Chinese and Central Asian peoples supported each other through adversity, and jointly made important contributions to the cause of justice of humanity. We should promote the correct view of history, defend the fruits of the victory of World War II, uphold the UN-centered international system, and provide more stability and certainty for world peace and development.

Distinguished Colleagues,

Friends,

China is building a great modern socialist country in all respects and advancing the great rejuvenation of the Chinese nation on all fronts through Chinese modernization. No matter how the international situation changes, China will remain unwavering in opening up to the outside world, and embrace higher-quality cooperation with Central Asian countries to deepen the integration of interests and achieve common development.

Distinguished Colleagues,

Friends,

Ancient Chinese philosophy advocates “mutual care and mutual benefit.” Similarly, a Central Asian proverb compares harmony and unity to happiness and wealth. China is ready to work with all parties to carry forward the China-Central Asia Spirit, pursue the goal of a community with a shared future, and strive for new progress in China-Central Asia cooperation.

Thank you.